As a daily Quicken 2016 Premier user, I upgraded to Quicken 2017 this week. The changes aren’t very significant but I chose to upgrade anyway and take a look. So here’s my Quicken 2017 review with my thoughts about the latest version. I’ve also updated my Income Portfolio Morningstar X-Ray and Credit Score too.

See how to download, install, and navigate Quicken. We also show you how to add accounts and use key tabs (Home, Reports, Budget, Bills, Calendar, and Alerts) to help you manage your money. To match the transactions, use your mouse to drag and drop the downloaded transaction on manually entered transaction (or vice-versa) to match the transactions. Match Downloaded Transactions with Manually Entered Ones in Quicken for Mac. I have a Quicken file containing bank data from 2000 and the accounts are set to manual entry with no online download / file storage. These are settings with the Quicken SW updates can be downloaded and installed as separate files and do not need to be updated only from within the program.

TLDR

- Enhanced mobile app features including investment tracking and offline use.

- No significant new functionality but it still does most of what you’ll need.

- Using Quicken requires at least a new purchase every three years for online connectivity.

- Updated user interface with a more modern look and support for higher resolution screens.

Quicken 2017 – what is it?

Quicken 2017 is the latest upgrade to one of the few remaining desktop finance applications for PCs & Macs. One newer competitor is MoneyDance. Other cloud-based alternatives (Mint, Personal Capital, etc) are very popular and growing at a fast rate. Sites such as YNAB have also gained a lot of traction.

Intuit, the company who originally made Quicken, sold the Quicken product to HIG Capital, a private equity company. Intuit is concentrating on cloud and online services with its popular (and free) mint.com website as well as its Quickbooks product for small business. They also make the popular TurboTax software. Quicken and Mint, despite having functionality, were never integrated over the seven year period after Intuit acquired Mint in 2009.

I already did a Quicken 2016 review earlier this year in April. The 2016 updates were largely minor and it wasn’t worth upgrading if you had Quicken 2015. Although Quicken 2017 is largely a refresh of the user interface to a more modern style, if you use Quicken 2015 there are more reasons to upgrade.

I upgraded because I wanted to review it and because the newer version should have better ongoing support. So I took advantage of the discounted price and redeemed some Microsoft Rewards I’d collected to knock the price down to $50.

Where to buy

Quicken 2017 comes in several different versions – Starter ($39.99), Deluxe ($74.99) and Premier ($109.99). There are two more advanced versions for Home & Business ($119.99) and Rental Property Manager ($164.99)

Note: The Starter Edition does not download data from higher versions of Quicken, so if you’re planning to downgrade keep this in mind.

If you are interested in purchasing Quicken, I suggest you shop around instead of buying directly from Intuit or using their Quicken upgrade offer. I bought my version of Quicken Premier 2017 from Amazon for $65.95, a 40% discount from the ‘official’ $109.99 price. Quicken have a promotion for the same price until the end of the month. Quicken Deluxe 2017 is $44.95 at the time I wrote this, compared to the official $74.99.

Quicken Editions

The Starter edition is only for new Quicken users as it doesn’t offer the ability to import older Quicken files. The Deluxe version is the standard version for most people and you only need the Premier version if you have investments at brokerages which you want to manage and review.

You can see a more detailed comparison at Quicken’s site. I use the investing features which are only available with Quicken Premier so that’s the only version I’m interested in.

All versions of Quicken work with a free mobile app. I’ve never used the app nor have I ever found myself needing to use one, so I won’t really comment on that. But it’s there if you want it. I turn off the “cloud synchronizing” feature which enables the mobile app functionality.

Installation and upgrade

Since I bought my copy from Amazon, I simply needed to download the 219MB installation file and run it.

After being greeted by the welcome screen above, installation was painless. It took about 30s to uninstall Quicken 2016 and install Quicken 2017. Now I think my data file is pretty big at 128MB as I have transactions going back to 2009, but it imported everything without any problems and I had no issues starting up Quicken afterwards. The file format hasn’t changed at all since I was able to load my new Quicken 2017 file into Quicken 2016 without any problems.

The installation does backup your Quicken 2016 file, so if something did go wrong you can always reinstall the older version and open up the saved file.

IDs, Passwords and Security

I didn’t have to fuss about license keys or anything like that during the installation, although I did need to enter my “Intuit ID” to register. This is an online ID which works across a range of Intuit products, although I wonder for how much longer considering they’re separate companies now.

Also in this version, Quicken asked for my mobile number and sent a two-factor code for protecting my account which was good. Even more convenient was how the SMS popped up as a windows 10 notification on my computer so I didn’t even have to dig out my phone.

The passwords in Quicken can be a little confusing – there are potentially three of them.

Intuit ID

This is used to register & login to the online website / mobile app. It is also needed whenever a new update is available, as you’re asked to enter this from time to time when using Quicken.

File Password

You can protect the Quicken data file using a password. This means you can only open the file after entering the password.

Vault Password

Your login credentials to online banks are stored in a ‘vault’ which has a separate password. Eeven if you don’t password protect your file (I don’t), then the Vault password needs to be entered the first time you download transactions from banks after starting Quicken. This process was simplified in Quicken 2016 so it’s a one-click operation after entering the password.

New Features for 2017

Here’s a summary of the three new features which are being offered for your hard-earned money in this version:

- New look that’s easier to use. This is just a straightforward re-skin of the user interface for the most part. Buttons are now flat and there’s more ‘blue’ in the screens. This upgrade does make working on higher resolution screens a little easier.

- New Mobile App. You can track investments on the go, enter transactions manually (even when offline) and search for transactions.

- Connect to Zillow. With the Premier version, you can automatically download the ZEstimate value of your house.

Mac users get a couple of extra features

- Quicken Bill Pay. For the princely sum of $9.95 a month it’s now a bit easier to pay bills online with Quicken and the add-on Quicken Bill Pay service. Let me think about that: Ally bank does that for free from their mobile app / website and even pays the postage when mailing a check; Quicken charges $10 a month. Hmm… a tough call. (Some banks may also offer a Quicken compatible service for free or for a charge)

- Easier upgrade from Windows to Mac. The Mac version can now understand a Windows Quicken file better. They listed this as a new feature last year too.

- Create custom reports. You can customize reports to look at specific accounts and time periods.

Reasons to upgrade

One of the main reasons for you to buy Quicken 2017 is because of the Discontinuation Policy.

Quicken provides phone and chat support for products per the above policy; it’s usually for 3 years. This also applies to some Quicken features such as downloading bank transactions. If you’re using Quicken 2014, those features will be disabled after April 2017 so you must upgrade before then if you wish to use continue those features.

I think part of the problem with Quicken is that it’s like Microsoft Word / Excel. It already does so much; there’s little more that it really needs to do. This is a software application that’s been around since 1983 after all. So upgrades do tend to be a bit underwhelming – most of the changes are probably ‘under the hood’ or to improve usability.

If you’re using Quicken 2016 there’s really no compelling reason to upgrade. However you might want to consider upgrading if you

- Want continued connectivity for downloading transactions through 2020.

- Want access to the ‘latest and greatest’ software / support.

- Like the new mobile app features.

- Use Quicken on higher resolution screens and find the screens to cluttered.

How To Match Downloaded And Manual Accounts In Quicken 2017 For Mac 2017

If you use Quicken 2015 or earlier, there are more reasons to upgrade. You’ll get continued connectivity for downloading online transactions and investment data.

The new look and feel

Here’s a before (Quicken 2016) and after (Quicken 2017) comparison of the new user interface, showing the investment register.

Quicken 2016 – Before…

It’s a very cramped / compact layout with different user interface styles in various parts of the screen.

Quicken 2017 – After…

Quicken 2017 adds more spacing around text and controls which can help when using the application with a touch-based laptop. It’s a step in the right direction, although there still seems to be quite a bit of needless chrome in the screens, and the screen redraws seem fairly slow compared to something like Excel or Word (this was true of Quicken 2016 too).

New Zillow Connection

I’m actually not big on tracking Net Worth – I use my Wet Worth instead which excludes house prices and retirement accounts.

But I do tend to keep an eye on my house price and Quicken 2017 now allows you to automatically download the estimated price for your house based on Zillow’s ZEstimate. I take the estimate with a grain of salt, but it’s nice to see any longer term trend in house prices. The connection worked first time – I just needed to enter my house address and it downloaded the current (ridiculously high) estimate from Zillow.

New mobile app features

The updated Quicken 2017 mobile app adds investment tracking and offline use, so it can be useful if you’re using an android tablet or iPad. I use a Microsoft Surface Pro 4 tablet around the house and when travelling which runs the full Windows application.

Features I don’t personally use

I’m probably not the average Quicken user, so here’s a quick overview of some of the Quicken features that I don’t use but that someone might find useful. I’ll mention why I don’t use them as I go. There’s not much difference from the 2016 version except for the styling as mentioned above.

Bill Reminder

You can enter all your bills, recurring or one-time charges and Quicken will flag you that you need to pay them when the time comes. When you pay (or say that you have paid) the bills they’re entered into your account register.

This screen is functionally the same as in Quicken 2016, although this year I’m showing the “Stack” view for extra style. The tab view along the top has been made blue and the second level menu is more consistent in style.

The bill reminder feature will try to estimate your bills using historical data if they are variable amounts and can’t get the billing info from an online provider.

I don’t use this feature however since I automate every bill payment as either an automatic credit card or bank payment, and track them in Excel. Entering them into Quicken in advance just means extra work for me. I just confirm that bills have been paid when the automatic bank download imports them.

Projected Balances

Based on your future bills and spending, Quicken can project your future balance. This can help you avoid being overdrawn as Quicken is currently projecting for me in February next year.

Of course, it’d probably help if I added my salary as a ‘bill’ so that Quicken knows there’s money headed my way. But the only time I look at this screen is when I’m reviewing Quicken. Personally I’m OCD about my future balances in Excel so I let it slide here.

Quicken will set up an automatic bill for personal loans and mortgages to track them and project the future balance.

Budgets

Each transaction in Quicken can be tagged with categories (and sub-categories). Budgets can be created with fixed amounts and can be set to roll-over from month to month if desired. Here’s a sample screenshot from my file. I was surprised to see some budgets set up so I must have played with it in the dim and distant past. There are also some alternate views I’m not showing here e.g. you can see a yearly view with the balance / budget of each month etc.

For some reason I just have trouble visualizing budgets like this, even though I know it’s really the same information that I have in the Excel file I use. I’m just much happier using Excel and my ‘budget’ process is more about keeping tabs on spending than imposing a monthly constraint.

Financial Planning

Quicken offers some tools for Debt Reduction, Lifetime Goals and Savings Goals.

The Debt Reduction and Savings Goals are the usual calculators allowing you to see the effects of additional payments etc. I’ve not tried them but I expect they’ll generate future transactions in your file and help show your progress to pay down debt or reach a savings target.

The lifetime goals tool is interesting though; it’s another wizard type tool that is similar to tools from Fidelity, Personal Capital, Vanguard and other brokerages. However it tries to fill out the details such as income and expenses etc. based on the history in your data file. The initial screen looks like this and is unchanged from Quicken 2016.

The results (as well as the graph color – purple is the new yellow it seems) have changed from last year’s review though. I’m not sure that Quicken is considering my intent to live of dividend income into its plan either.

As far as I can tell it grows the Taxable and Tax-Advantaged accounts that you selected with your estimated growth rates. It then decreases them per your living expenses when you reach retirement age. Sadly it said that I should only expect to live until I’m 82 years old, which is 37 years away. Although apparently I might make it another ten years as a stretch goal!

Quicken will update the results as time progresses based on your current account balances. You can also explore “What If” scenarios and see the results. It might be worth digging into the numbers / assumptions more in a subsequent post, but I do my future projections in … you guessed it, Excel.

Mortgage & debt calculators

If you have a mortgage, Quicken provides charts and reports to review the effects of additional payments or re-financing. It’s all pretty good and it’ll calculate interest and principal payments for your mortgage and categorize them appropriately. Nothing that isn’t available online but here it’s all linked with your account transactions.

Quicken also includes a Debt Reduction calculator to estimate the interest on your debt and create a payment plan.

Reports, Reports, Reports

Quicken has a huge number of reports that it can generate. Net Worth, Cash Flow, Investment Performance, Spending comparisons, you name it. I’ve showed some in the screen capture below.

At the bottom of the list is the cool “Easy Answer” wizard where you can select questions such as “Am I saving more or less compared to last year?” and it’ll produce a report to answer your question. The reports can all be produced manually via the reporting / query tools but the questions get you straight to the specific report that you want.

I’ve just never found myself asking Quicken those questions, but you certainly can if you want to.

Features I actually use every day

So that’s a lot of features that I don’t actually use! You’re probably wondering why I even bothered to upgrade and what I actually do use in Quicken. Well here they are.

Linked transactions

Quicken tries to link every transaction between two accounts. So if you transfer money from Checking to Savings, it’s one transaction and has a “from” and a “to” account. This is handy because it allows you to navigate from one account to the other. You can click on the deposit and then navigate to the outgoing transaction. Likewise changing the amount in one account will change the amount in the other account since they’re linked. It requires some logic to match up transactions and sometimes Quicken needs a little help. I’ve even had two entries in one account link to a single entry in another account which is, well, wrong.

You can always work-around this; for example you can simply withdraw cash or add and remove investments without requiring a second account. But the majority of transactions are linked and show flows between accounts.

Online account synchronization

Quicken can connect to all my accounts and download the latest transactions. I have a number of savings, checking and brokerage accounts between Vanguard, American Express, Charles Schwab, Chase, Barclays, Fidelity, HSBC and Capital One. Quicken can pull all this information in one go.

This is the feature I use the most as it allows me to review all transactions going through all my accounts and helps me check off the transactions as they occur in my Excel file. The only account it’s not able to access is my HSA account at Bank of America. This also has the dubious honor of being the worst banking website that I have to use.

Note: Mint.com, Personal Capital and others can do all this too, but what I like about Quicken compared to Mint is that the transactions are linked between accounts as I mentioned above.

Historical Investment Cost Basis

This is the feature I use next often. Quicken provides a very simple interface for viewing the value of your portfolio on any given date. This feature works on all investment accounts since Quicken downloads the historical price data for each stock / fund that you own.

Here for example is a portion of my Capital One account, showing my LNT purchases and associated cost data. By changing the date in the “As of” field at the top, I can go back in time and see values on different dates which helps me in producing monthly and yearly reports. Sadly you still can’t go forward in time and look at future stock prices. That’d be a feature worth buying!

The little report icon to the right of the stock name links to news relating to that company such as dividend increases and other events.

Consolidated stock data

I’ve also recently started using a custom investment view. This allows me to look at all my individual stock holdings across all brokerages and it adds fundamental data too. You can create a specific view containing the investment holdings you select as well as choosing the columns to be displayed from a long list of fundamental data values.

The view below is for one I created for all individual stocks in my Income Fund, aggregated across brokerages. The columns are those I typically look at when considering new purchases and in this screen I’ve hovered over the news report where links to company news are located.

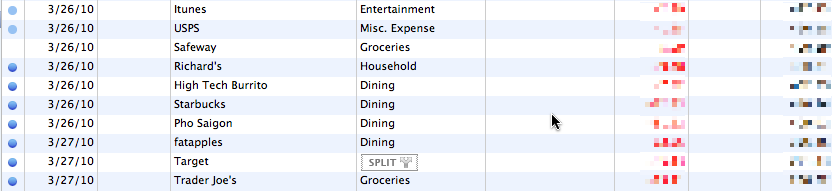

Expense Categorization

Quicken allows each transaction to be classified with a category so I occasionally use that feature when reconciling with my Excel sheet where I budget based on categories. It can generate reports that group expenses into each category and provide a breakdown into sub-categories. I’ve used this a few times when the expenses in my accounts don’t match my Excel file.

My Credit Score

All versions offer a Free Credit score report – this is a quarterly report from Equifax and it offers some basic personalized advice based on your credit report. The Score is not the “FICO” score but the Equifax Credit Score. The report consists of the following sections “Credit Card Usage”, “Payment History”, “Age of Credit”, “Total Accounts”, “Credit Inquiries” and “Derogatory Marks”.

My Score

I was at 820 at the time of the last review six months ago so no changes here. Of course it’s a different score (higher) than the one I get through my credit card, but I suppose score trends are more important than absolute credit score numbers .

The Quicken credit score report is available quarterly and provides some explanation on factors which are causing issues with the score. So it’s not that bad. But I get free monthly FICO credit scores from holding the Chase Slate card (no annual fee) and my American Express card provides it too, both of which are better than the quarterly update here. Chase have the best report of the three and use the same score as American Express.

Tracking Investments in Quicken 2017

Morningstar X-Ray

Morningstar offer an X-Ray feature if you pay their subscription fee and this analyses your portfolio holdings, breaking them into sector and regions. This can help you see what you really have in your portfolio and what you might be exposed to; particularly if you hold a number of mutual funds.

For example if you hold individual shares in Apple, you might want to limit ownership to say 10% of your total portfolio. But if you also own ETF or index funds, they may hold Apple stocks too so you could own more Apple stock than you think.

Quicken has partnered with Morningstar to offer this feature for free, and the report can be customized to view one or all of your investment & retirement accounts. You may also be able to get access to Morningstar from your local library for free too.

I don’t use this feature much but here are the current results from my Income Fund to give you an idea of the kind of analysis that it produces.

Asset Allocation

I’ve moved from “moderately risky” to “aggressive” now that bonds and cash in my Income Fund have fallen below 40%.

Investments by Region

Compared to last year my US sector allocation increased from 73% to 78% at the expense of Europe and Asia. My low allocation to Japan has even generated a warning.

Since the Quicken 2016 review, I’ve switched from Vanguard’s Total International Stock Market fund (VTIAX) to the Vanguard International High Dividend Yield Index Fund Admiral Shares fund (VIHAX). So the new allocation is essentially saying that not many Japanese companies are paying high dividend yields at the moment. I wrote about global international dividend trends recently.

Stock Sectors Summary

The report includes a more details stock sector allocation which can be compared to the S&P 500 or a similar investment style benchmark.

Stock & Bond Style

The portfolio has moved even more towards Large Value stocks. This is not too surprising. Most high-yield dividend stocks tend to be Value stocks and I favor large-cap stocks for the most part.

Investment Type & Fees

No warnings this time – in my Quicken 2016 review this April I was flagged for being over-allocated to Slow Growth and under-allocated to Aggressive Growth. I’ve not paid any attention to this attribute in any purchasing decision, so I arrived at the current allocation by happenstance.

Stock Intersection

The stock intersection view shows how the individual stocks you hold are held by other investment funds or ETFs. In my case, Microsoft is one my largest individual stock positions and it’s also one of the largest holdings in VHDYX.

Investment performance

There are also a number of investment reports that can be customized based on the securities you select. The reports can be quite interesting if you want to compare your portfolio’s performance to major stock indexes etc. Here’s my updated Capital One account performance compared to the S&P and other indexes.

I’m never exactly sure what’s being compared in these type of performance charts so I don’t pay them much attention. I don’t believe these particular results either, especially since dividends aren’t included in the calculations. The index data only goes back 5 years which is pretty bad too.

Quicken in daily use

I usually use Quicken once a day to download transactions and keep an eye on my accounts. For the most part, it’s trouble free and works well.

Online connections

Chase connectivity has been intermittent in the past but very reliable recently. My Amex Savings account currently isn’t syncing but I don’t use that account for much so I manually enter transactions for the moment.

I’ve always been able to contact support when needed although it’s a fairly lengthy process. Phone / Chat support has been pretty good and has resolved any issue I’ve had. So no complaints there, only procrastination on my part in getting the Amex connection fixed.

Investment Tracking

It can be a fair amount of work to keep the investment data correct with investment accounts especially. Some brokerages are better than others; I have a lot less issues with Capital One for example. However the Vanguard import in particular can get confused due to delays in the transactions between institutions, and the use of a money market sweep fund vs a cash account.

So you do need to babysit the transactions and make sure everything gets linked up correctly. However most of the time transactions, even those from stock splits and mergers, get handled correctly.

Summary

How To Match Downloaded And Manual Accounts In Quicken 2017 For Mac Manual

This isn’t a must-upgrade by any means, but pretty good if you like Quicken and are using one of the older versions. You may also value the new mobile app functionality and better support that Quicken 2017 has in which case it’s definitely worth it.

How To Match Downloaded And Manual Accounts In Quicken 2017 For Mac For Dummies

On the other hand, if you’re using Mint or Personal Capital or some other free service, there’s likely little value here in Quicken unless you’re OCD like I am and want total control over all transactions. I find the investment data useful, but that too can be found at some online brokerages. Brokerages also have analyst reports that I find useful which aren’t available in Quicken.

The Starter Edition does give you a means to check your Credit Score quarterly for the next several years for ~$29.99 which is cheaper than many credit monitoring services (e.g. IdentityGuard, Experian, Lifelock etc). You don’t get the credit monitoring aspect of those services thought. Alternatively you can get a Chase Slate card or similar and obtain free credit scores.

I hope you found this Quicken 2017 review useful. Let me know if you have any questions about it. I don’t get paid to promote Quicken so I try to highlight both the good and the bad. However I do earn a small payment if you buy Quicken via Amazon from this page.

Quote of the day

An investment in knowledge pays the best interest.